Retirement Savings - 2026 Contribution Limits

2026 Retirement Contribution Limits Released

Retirement plans are a great way to grow your assets through tax-deferred or tax-free compounding. The IRS just released the updated contribution limits for 2026, and several common plans are getting increases.

If you’re still working toward your 2025 contribution goals, remember that IRA/Roth IRA contributions can be made until the April 2026 tax-filing deadline, while employer-sponsored plan contributions must be made by December 31.

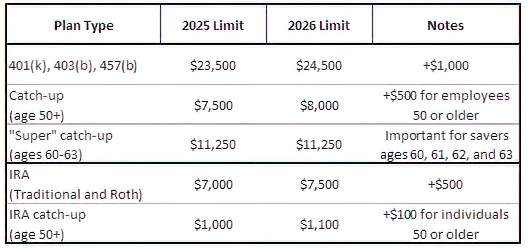

Below is a quick breakdown of the 2025 and 2026 limits for the most widely used retirement plans:

Other Things to Consider:

• Roth IRA phase-out ranges vary based on your Modified Adjusted Gross Income (MAGI) and filing status: Income thresholds determine whether you can contribute directly to a Roth IRA. Some of the income ranges increased in 2026 and depend on whether you file as single, married filing jointly, married filing separately, or qualifying widow(er). Your Portfolio Manager can help you determine your eligibility.

• Additional plan types exist: SIMPLE IRAs, SEP IRAs, and other employer-sponsored plans have their own limits and rules. If you participate in one of these, we’re happy to walk through those details with you.

• Choosing the right contribution mix matters: Whether you maximize contributions, use pre-tax vs. Roth deferrals, or coordinate across multiple accounts, a thoughtful strategy can make a meaningful difference over the long-term.

• It’s also a good time to review your IRA beneficiary designations: Life changes, new family circumstances, and outdated forms can all lead to unintended outcomes.

Talk With Your Portfolio Manager

If you’d like to review your savings rate, confirm your IRA beneficiary designations, or discuss how these updated 2026 limits fit into your overall financial plan, please reach out to your Portfolio Manager. We’re here to help you make the most of every planning opportunity!