Buried in the Fine Print

Thursday, November 6, 2025

Written by Nathan Polackwich, CFA

Categories: General Markets and Economy

There was a remarkable disclosure buried in the footnotes of Microsoft’s most recent quarterly report:

“For the three months ended September 30, 2025 and 2024, other income (expense), net included $4.1 billion and $688 million, respectively, of net losses from investments in OpenAI, primarily net recognized losses on our equity method investment.”

Microsoft held a 32.5% stake in OpenAI, the leading generative AI company and maker of ChatGPT, for most of the quarter (it ended October at 27% after an ownership restructuring). Because Microsoft doesn’t own more than 50%, it must use equity-method accounting for its OpenAI investment, which means it reports its proportional share of the losses (or profits if they exist). In the most recent quarter, Microsoft’s share of OpenAI’s losses was $4.1 billion.

This is an incredible revelation because it means OpenAI as a whole lost an astounding $12.6 billion last quarter. Keep in mind they’re only generating something like $3-$4 billion in quarterly revenue (they're a private company, which means we have to rely on outside estimates and management commentary). So, OpenAI is now losing $50.4 billion a year on perhaps $12 to $15 billion in revenue, which might qualify as one of the worst business models of all time. No wonder their CFO is floating the idea of a federal backstop for its business: (see OpenAI Wants Federal Backstop).

Despite these massive losses, OpenAI has signed over $1 trillion in long-dated commitments for semiconductor chips and compute capacity from companies like Nvidia, Oracle, and others. But not only does OpenAI lack anything close to the capital to fulfill these agreements, given its current cash burn rate it may be lucky just to keep the lights on.

So far, investors don’t seem overly concerned, as large-cap tech stocks continue to make new highs mostly on the back of hype surrounding AI and OpenAI’s outlandish promises. In fact, the A.I. boom has already grown into perhaps the largest speculative frenzy in market history. Analysts at the independent market research firm MacroStrategy Partnership recently estimated that today’s AI bubble – which they define as the misallocation of capital – has already swelled to a staggering 17 times the dot-com era at its peak, and more than four times the scale of the subprime bubble. Goldman Sachs says that borrowing by AI-related firms this year has exploded to $141 billion, as debt has become increasingly necessary for the party to continue.

The level of stock market concentration is also in uncharted territory. The Magnificent 7 – Microsoft, Apple, Nvidia, Meta, Google, Tesla, and Amazon – now comprise fully 35% of the S&P 500. If you include all technology stocks, the sector is now almost half the stock market’s value. Note that at the peak of the Internet bubble in March 2000, tech stocks represented 34.8% of the S&P 500. A few years later, after the bubble burst, tech had fallen to just 14% of the market.

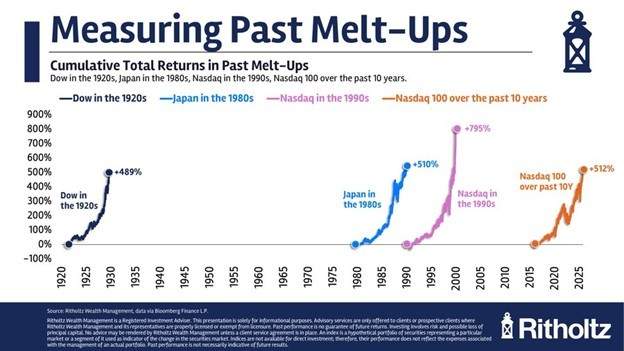

At some point, the hundreds of billions being spent on AI data centers and model training will have to produce some sort of return on investment in order to continue. If the economics of OpenAI’s business are any indication, the optimists are living on borrowed time and today’s stock market mania is likely headed for the same ending as prior bubbles.